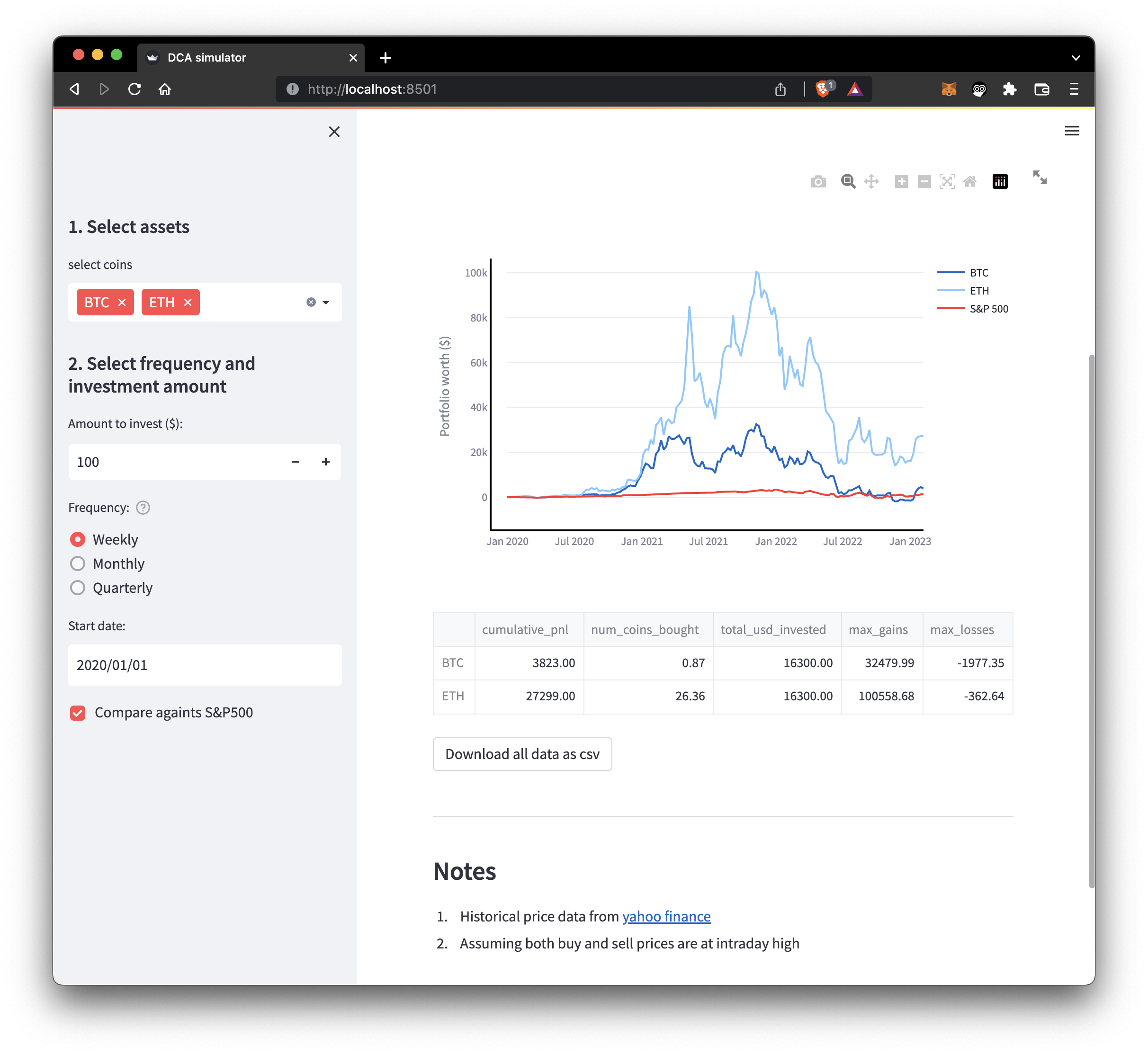

Building a DCA simulation apps with Streamlit

What is DCA?

DCA stands for “Dollar Cost Averaging” and it refers to a strategy of investing a fixed amount of money into an asset at regular intervals over a long period of time, rather than making a lump-sum investment all at once.

| Benefits | Drawbacks |

|---|---|

| * Reduced risk of buying at a market high: By investing a fixed amount at regular intervals, you reduce the risk of investing a large amount of money at the wrong time, such as when the market is at a high point. | * Missed opportunities: If the market is rising, you may miss out on the potential for higher returns by not investing a larger amount when the market is high. |

| * Averaging in: Over time, DCA helps to average out the cost of an investment, potentially reducing the average cost per unit of the asset. | * No guarantee of higher returns: Just because DCA reduces the risk of buying at a market high, it does not guarantee higher returns. |

| * Mental discipline: DCA can also help to encourage a disciplined investment approach, as it requires setting aside a fixed amount of money on a regular basis and sticking to the plan, even during market fluctuations | * Timing still matters: While DCA can help to average out the cost of an investment, timing still matters. If the market declines significantly over the long-term, the overall return on investment will likely be lower. |

DCA can be a good strategy for some investors, especially those who are risk-averse and want to reduce the impact of market fluctuations on their investments. However, it is not a guaranteed strategy and like any investment, it involves risk. It is important to consider your personal financial situation and investment goals before choosing an investment strategy.